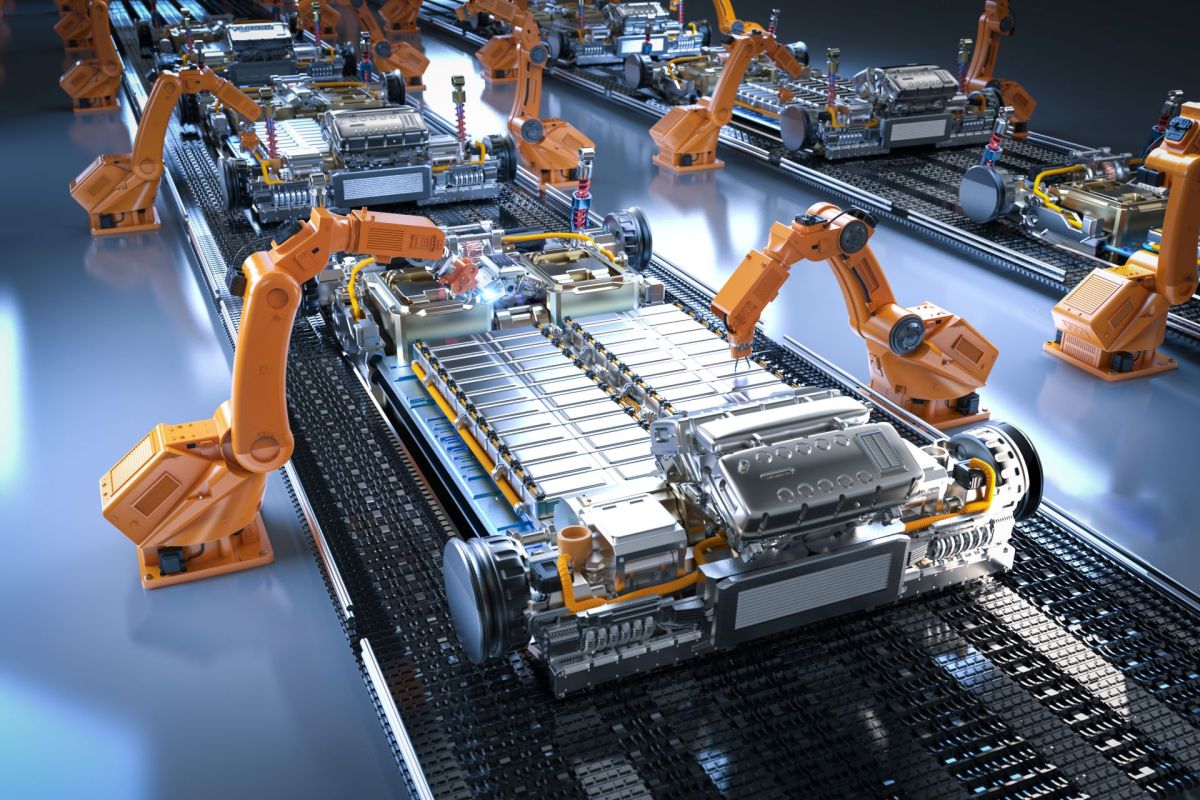

In February, Ford announced that it planned to build a factory in Michigan to produce affordable lithium iron phosphate (LFP) batteries for its electric vehicles in partnership with Chinese battery maker CATL, per the MIT Technology Review, but that deal and the plant's production plans have seen a rocky road since.

The deal with CATL came under scrutiny in the U.S. House of Representatives, with the House Energy and Commerce Committee sending a letter to Ford in September requesting more information about the nature of the partnership.

"While Ford has labeled this project a 'commitment to American manufacturing' and asserts it will create 2,500 new American jobs," the letter states, "we are concerned that Ford's partnership with a Chinese company could aid China's efforts to expand its control over United States electric vehicle supply chains and jeopardize national security by furthering dependence on China."

Ford has maintained that CATL won't have an active stake in the deal and won't receive U.S. tax dollars. But then the automaker reportedly halted production on the facility, according to The Washington Post, amid labor strikes and the congressional inquiry.

In November, Ford further announced that it would scale back its plan for the Michigan plant, cutting production capacity and reducing expected employment down to 1,700 jobs. This shift is believed to be due to lower-than-expected consumer demand and increased labor costs.

"We're trying to be smart about this and how we move forward," said Ford Chief Communications Officer Mark Truby.

Ford's new facility is still expected to open in 2026 using technology licensed from CATL, MIT says, rather than any batteries directly manufactured by the Chinese giant. The deal would represent a $3.5 billion investment in the EV market, and the factory would be the first of its type in the U.S. "This is a big deal," said Michigan governor Gretchen Whitmer at the press conference announcing the plan.

Most lithium batteries use additional metals, like nickel and cobalt, to help them store energy. But most of these metals are rare and expensive. LFP batteries use ordinary iron instead — a much more affordable alternative. According to MIT, batteries of this type are about 20% cheaper on average.

Iron-heavy lithium batteries have been around for a long time, MIT says. But they have been previously overlooked as an option for EVs because batteries made with the metal could not store as much energy as other lithium batteries of the same size. Companies were focused on achieving a greater range for their vehicles, so they favored the smaller, lighter batteries.

However, as demand for EVs increases, the cost and scarcity behind procuring rare metals is becoming a bigger problem. Cobalt is especially problematic because mining it is dangerous, as the New Yorker reports.

EV manufacturers like Tesla have switched to using LFP batteries for some models, such as the Model 3, and MIT says that these batteries have already been popular in China for a few years. Ford has announced it will use LFP batteries in the 2023 Mach-E starting in the 2023 and 2024 F-150 Lightning models, but for now, it will need to import them, as there are currently no LFP manufacturers in the U.S. However, MIT reported that several others are in the works in addition to Ford's factory.

Join our free newsletter for weekly updates on the coolest innovations improving our lives and saving our planet.