A new report shows that only 34% of U.S. employees think their employers are doing enough to address climate and sustainability issues, a drop from 53% in 2021 — and a growing chorus of employees are pushing their companies to do more.

The survey by Deloitte of over 20,000 employees also indicated that employees' perceptions of their employers' sustainability commitments could be impacting their decision to take a job or stay with the company.

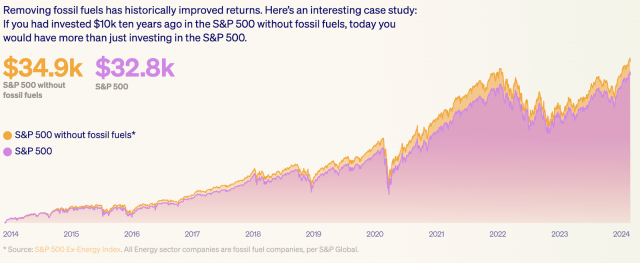

One change some employees are pushing for is easier and better climate-friendly options within 401(k) programs. That's because almost all 401(k) programs invest in fossil fuels, which has been the S&P 500's worst-performing sector for the past 10-20 years and is at odds with many companies' sustainability goals, like increasing renewable energy and decreasing pollution.

On the heels of Google's decision to add a climate-friendly fund to its 401(k) plan, an ex-Apple employee, who asked to remain anonymous, spoke to The Cool Down about his efforts, alongside other colleagues, to persuade Apple to do the same.

Ex-Apple employee speaks out

While Apple's 401(k) program does offer a "self-directed brokerage" that allows employees to have more choice in where their 401(k) investments go — certainly a step ahead of what many companies offer — the ex-Apple employee we spoke to said it was hard to navigate.

"It took like eight or 10 steps," he explained. "There weren't a lot of resources explaining to people how to do it," adding that he felt it was unrealistic for employees to have the time and bandwidth to research the climate credentials of potential investments.

TCD Picks » Upway Spotlight

💡Upway makes it easy to find discounts of up to 60% on premium e-bike brands

Over four years ago, he said, he started asking the Apple benefits team if they would add a more turnkey climate-friendly fund as one of their pre-selected options. He shared the data about the underperformance of the oil and gas industry and the overperformance of "ESG funds" in comparison.

More recently, he shared Google's decision to add a fossil-free fund, the Parnassus Core Equity Fund, to its 401(k) investment options after their regular review process revealed underperformance of one of their actively managed funds.

"Here is one of our direct peers in the Bay Area — similar employee base, similar values, and they're encouraging their employees to do this," he said. "And they [Apple] basically said, 'we'll think about it.'"

|

Should the government provide incentives to buy EVs?

Click your choice to see results and speak your mind. |

Other employers, particularly those who offer "passively managed funds," have also added the Sphere fund as a climate-friendly option, which is easily offered as an option in popular 401(k) platforms like Fidelity and Schwab.

TCD Picks » Stasher Spotlight

💡Stasher's reusable food storage options make it easy and affordable to live life with less plastic

According to Sphere, Apple has invested over $447 million in the fossil fuel industry via its 401(k) investments, citing data from the Department of Labor.

The ex-Apple employee we spoke to was complimentary of a lot of the sustainability work the company is pursuing. But he also said he and his colleagues expressed concerns about the Apple Card rewards program being incompatible with Apple's climate commitments by offering cash back on gasoline through the Apple Card, and he raised that with the benefits team as well.

(The Apple Card rewards program offers customers 3% back on Exxon and Mobil purchases, though it should be noted that's at least in addition to 3% cash back on electric vehicle charging through a partnership with Chargepoint.)

"I think that their vision of sustainability is very focused on Apple's operations and on Apple's supply chain, and not really focused on employees," he said.

The Cool Down reached out to Apple for a response, but Apple reps declined to comment. In addition to their "self-directed" brokerage items that do at least give employees an opportunity to direct their retirement investments more manually, publicly available information shows that Apple facilities worldwide, including corporate offices and retail stores, run on 100% renewable energy. They provide charging stations for EVs across their U.S. campuses, and their recycling and composting efforts across their corporate operations resulted in a 70% waste diversion.

Ultimately, the employee we spoke to left the company recently, without any meaningful progress from Apple. "I don't know how much I was able to move the needle before I left," he said.

How employees can influence companies

Employees can have a big impact in driving positive climate impact within their companies, said Deborah McNamara, Executive Director of ClimateVoice, a group that activates employees to push for climate-friendly corporate policies.

"For example, 59% of business leaders say that employee climate action caused them to increase their sustainability efforts," she told The Cool Down. "There is an enormous opportunity here for employees to speak up."

Examples, she said, include asking business leaders to support climate-related policies and initiatives, sharing calls to action via internal company and employee Slack channels, and submitting public comments during regulatory open comment periods.

ClimateVoice suggests employees start by getting the facts and doing research about the issues you want to tackle. Companies often have employee engagement groups focused on green initiatives, but if you don't have one, engage your coworkers to build community around your efforts. You can also have conversations with your peers and company leaders about your concerns, advocating for action.

ClimateVoice just published an Employee Climate Action Checklist, which also includes simple steps you can take to get started and learn more about using your influence for positive change.

"The key is to find others who share your concerns, band together and speak up as a collective," McNamara said. "Silence will not lead us to a better future. Practicing moral courage will. We need more of us stepping out and speaking up for people and the planet despite moves to foster fear. We need to normalize taking action to defend what we care about: healthy communities, clean air and a livable climate."

How to advocate for a climate-friendly fund for your 401(k) plan

Switching where your money is invested could have a bigger impact than putting solar panels on your roof, reducing your air travel, or planting 100 degrees, according to data from RetireBigOil.org, an organization that has been working with the SAG-AFTRA actors union to move their pension funds out of fossil fuels.

The first step to asking for a climate-free fund is emailing your HR rep, or your 401(k) provider directly, who often like to get feedback from employees, says Alex Wright-Gladstein, the founder and CEO of Sphere. (The Cool Down put together a full guide to switching your 401(k), including an email template, here.)

It's important to note that they don't have to change their 401(k) provider to add a climate-friendly fund. One caution: If your company or adviser says they already invest in "ESG" or "sustainable" funds, do a little more research by typing their name into FossilFreeFunds.org to learn more and see if there are further improvements to make to the offerings.

If you hear back that there are roadblocks, ask what they are and try to map out a plan to solve them — oftentimes, the pathway to adding climate-friendly 401(k) options is actually very simple and smooth once the decision is made to do it.

If you decide to ask your employer about a climate-friendly 401(k) plan, we want to hear about your experience! Email us at hello@thecooldown.com.

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.